Page 15 - 031120-Market-Bulletin

P. 15

WEDNESDAY, MARCH 11, 2020 FARMERS AND CONSUMERS MARKET BULLETIN – 404-656-3722 – agr.georgia.gov PAGE 15

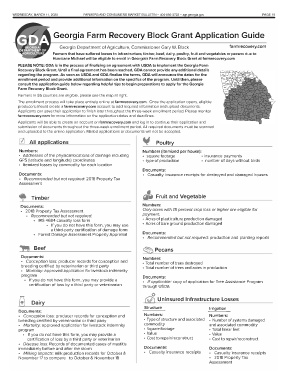

Georgia Farm Recovery Block Grant Application Guide

Georgia Department of Agriculture, Commissioner Gary W. Black farmrecovery.com

Farmers that have suffered losses to infrastructure, timber, beef, dairy, poultry, fruit and vegetables or pecans due to

Hurricane Michael will be eligible to enroll in Georgia's Farm Recovery Block Grant at farmrecovery.com

PLEASE NOTE: GDA is in the process of finalizing an agreement with USDA to implement the Georgia Farm

Recovery Block Grant. Until a final agreement has been reached, GDA cannot provide any additional details

regarding the program. As soon as USDA and GDA finalize the terms, GDA will announce the dates for the

enrollment period and provide additional information on the specifics of the program. Until then, please

consult the application guide below regarding helpful tips to begin preparations to apply for the Georgia

Farm Recovery Block Grant.

Farmers in 95 counties are eligible, please see the map at right.

The enrollment process will take place entirely online at farmrecovery.com. Once the application opens, eligible

producers should create a farmrecovery.com account to add required information and upload documents.

Applicants can save their application to finish later throughout the three-week enrollment period. Please monitor

farmrecovery.com for more information on the application dates and deadlines.

Applicants will be able to create an account on farmrecovery.com and log in to continue their application and

submission of documents throughout the three-week enrollment period. All required documents must be scanned

and uploaded to the online application. Mailed applications or documents will not be accepted.

0 All a lications Poultry

Numbers: Numbers (itemized per house):

• Addresses of the physical locations of damage including • square footage • insurance payments

GPS (latitude and longitude) coordinates • type of production • number of days without birds

• Itemized losses by commodity for each location

Documents:

Documents: • Casualty insurance receipts for destroyed and damaged houses

• Recommended but not required: 2018 Property Tax

Assessment

• Timber � Fruit and Vegetable

Documents: Numbers:

Only acres with 15 percent crop loss or higher are eligible for

• 2018 Property Tax Assessment

• Recommended but not required: payment.

• Acres of plasticulture production damaged

• IRS 4684 casualty loss form

• Acres of bare ground production damaged

• If you do not have this form, you may use

a third-party certification of damage form

Documents:

• Forest Damage Assessment Property Appraisal

• Recommended but not required: production and planting reports

� Beef �Pecans

Documents: Numbers:

• Conception loss: producer records for conception and

• Total number of trees destroyed

breeding certified by veterinarian or third party

• Total number of trees and acres in production

• Mortality: approved application for livestock indemnity

program

Documents:

• If you do not have this form, you may provide a

• If applicable: copy of application for Tree Assistance Program

certification of loss by a third party or veterinarian

through USDA

i)

� Dairy � Uninsured Infrastructure Losses

Structure Irrigation

Documents:

Numbers: Numbers:

• Conception loss: producer records for conception and

breeding certified by veterinarian or third party • Type of structure and associated • Number of systems damaged

• Mortality: approved application for livestock indemnity commodity and associated commodity

• Square footage

program • Total linear feet

• Value

• If you do not have this form, you may provide a • Value

certification of loss by a third party or veterinarian • Cost to repair/reconstruct • Cost to repair/reconstruct

• Disease loss: Records of documented cases of mastitis

Documents: Documents:

immediately before and after the storm

• Milking impacts: milk production records for October & • Casualty insurance receipts • Casualty insurance receipts

November 17 to compare to October & November 18 • 2018 Property Tax

Assessment